Managed Compliance

More and more businesses have compliance requirements today. We all understand healthcare and financial services compliance needs but many do not understand the exact nature of those compliance needs. Then there are other businesses who may not even know they are required to have some form of compliance.

No matter where you fall on the spectrum we can help with your ongoing compliance needs, and if you take credit card/debit card payments you have compliance rules.

Nwaj Tech has been providing healthcare and law firms compliance support for more than 4 years. We have since expanded to offer compliance support to any business that has compliance needs.

Who Should Partner With Nwaj Tech for Managed Compliance

Compliance and regulations for any business that maintains client data are required. It is always evolving and sometimes very complex. Depending on your business you may have state and federal compliance requirements. You may only have to manage one or the other. If you conduct business with consumers in California or Connecticut (and a handful of other states) you may have other considerations.

You should work with Nwaj Tech for Managed Compliance if (not an all-inclusive list):

- Your business is a healthcare, legal, or financial services business

- You maintain client data identified as Personally Identifiable Information (PII)

- You accept credit/debit cards for payment

- You offer credit or financing to your clients

- You are a vendor that provides services to healthcare

- You do business with European consumers

- You do business with consumers in Connecticut, Colorado, California, Utah, or Virginia

- You work with the Department of Defense

Compliance is not a one-and-done process. It is ongoing. You will identify areas of risk that need to be addressed. There will be changes in your business and to the requirements for compliance. Managed compliance allows us to proactively ensure your business is always compliant with local, state, and federal compliance regulations.

Benefits of Managed Compliance

- Understand your compliance requirements

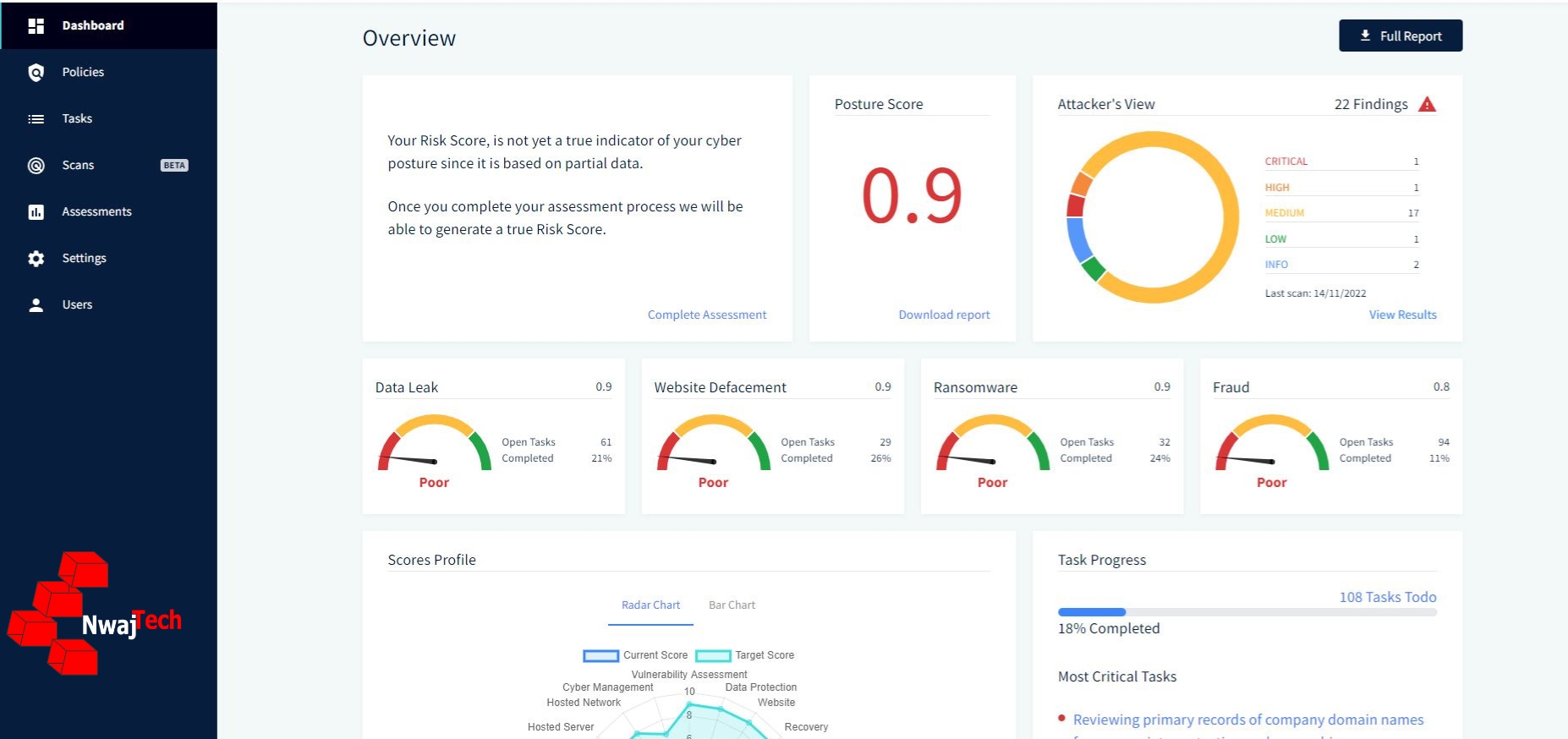

- Know where you stand with your compliance program

- Never worry about maintaining compliance or updates to compliance needs

- Free up your time to run your business

- Identify and mitigate risks you may not be aware of

- Demonstrate cybersecurity maturity and due diligence/due care efforts

- Protect your clients personal data (PII & PHI)

Often businesses don’t know what they don’t know. Processes that may have been put in place at one time to improve productivity or efficiency may not meet compliance regulations today. Something as simple as using an easy-to-remember password shared with a few of your co-workers to make it easier for the entire department also makes it easier for attackers to steal sensitive client information.

Protecting personally identifiable information, payment information, and protected health information is the end game for regulatory compliance. Simply stated, protecting sensitive customer information is why you should, and are required to, have a compliance program in place.

You’re in business which means you have customers. You likely strive to provide a high level of customer service. Protecting their data should be part of customer service.

That’s the basis for compliance. Protecting customer data.

Are you compliant?